Update Report PVS Q4.2023

Update Report PVS Q4.2023

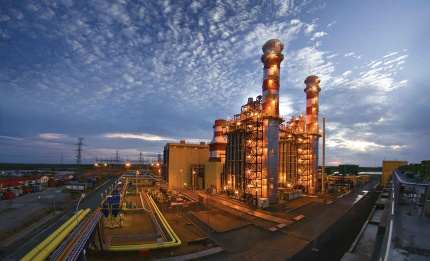

PRIMED FOR STRONG GROWTH AND RETURNS

- High oil price continues to support upstream operation activities. 2023 was another highly productive and successful year for Petrovietnam Technical Services Corporation (PTSC) with many domestic and international awarded M&C offshore contracts. Forecasted oil price remained high throughout 2024 by major institutions is seen as a primary driving force for vibrant upstream operations.

- Renewable energy transition – long-term value creation. According to Vietnam’s Eighth National Power Development Plan (PDP VIII), Vietnam’s ambition and commitment to transition toward renewable energy will hugely benefit PTSC in the long-term by actively promoting research and investment in renewable energy projects, with a focus on offshore wind power. The partnership with Denmark’s Ørsted to manufacture and supply turbine foundations for Greater Changhua offshore windfarms project in Taiwan marked a remarkable milestone for PTSC’s development and renewable energy transition commitment.

- Lac Da Vang project has received Final Investment Decision from U.S. Murphy Oil. The project will generate considerable workload for PTSC with the total contract value of $283 million, from 2024-2026.

- Block B – O Mon project awaiting Final Investment Decision. On 30/10/2023, PTSC, in a consortium with McDermott, has been awarded a key contract from Phu Quoc Petroleum Operating Company (PQPOC) for an engineering, procurement, construction, installation (EPCI#1) on Block B – O Mon gas-to-power upstream project with a total estimated contract value of $1 billion. On the same period, PVS also landed an upstream contract EPCI#2 ($300 mil) from PQPOC and potentially another EPCI contract for Block B – O Mon midstream gas pipeline. A Final Investment Decision (FID) is expected to be reached in mid-2024, promising to create many jobs across the network chain.

- Outlook & valuation. We estimate a strong FY24 revenue growth of 22,252 billion VND (+15% YoY), slight margins expansion with gross margin and net margin increasing to 5.09% and 4.65%, respectively, led by robust M&C segment outlook, high FPSO/FSO utilization rate and strong cash balance. We base our 2024 12-mo target price of 40,755 VND/share for PVS on a 5-year forecasted period using the equal weight of discounted cash flow method (FCFE) and comparative method (P/B, P/E).

Báo cáo liên quan

Tin tức liên quan

Xem tất cảBạn cần tư vấn bởi chuyên gia?